May, 2022

What’s in a name?

A reflection of 21st Century America.

Data from the U.S. Census Bureau prior to the 2020 census shows that among the top 13 most common surnames in America, Spanish surnames ranked 6, 9, 10, 11, 12, and 13. In fact, 35% of Americans with the top 13 most common surnames have a Spanish surname.

Those names, in order are:

Garcia … Rodriguez … Martinez … Hernandez … Lopez … Gonzales

In five states, Spanish surnames are one or more of the top 3 most common names. In California, the top 3 most common names are all Spanish, including Garcia, Hernandez, and Lopez. In Texas, Garcia is the most common surname and Martinez ranks third. In Colorado, Martinez is third most common. In Arizona, Garcia is third most common. And in New Mexico, as in California, the 3 most common are all Spanish, including Martinez, Garcia, and Chavez.

The data show that the number of Latino surnames in the top 25 doubled between 1990 and 2000 alone, demonstrating the dramatic demographic shift from 20th Century America to 21st Century America. When the Census Bureau provides the newest update on Surnames, Spanish surnames are expected to have climbed even higher in the rankings as the U.S. Latino population continues to lead our country’s growth.

It is estimated that by 2060 the U.S. Latino population will be nearly 111 million people.

U.S. Latino Workers Prioritizing Heath

According to a 2022 Work Trend poll conducted by Microsoft, two-thirds of Latinos say they are now much more conscious about prioritizing health over their work when it comes to going to the office. That compares to 55% of the general U.S. working population. In addition, 60% of U.S. Latinos say they are considering changing jobs, compared to 45% of the general employee population. About one-third of U.S. Latinos polled said they have already actually moved to another company, compared to about one-fifth of all others.

The top five reasons employees quit were: personal wellbeing or mental health (24%), work-life balance (24%), risk of getting COVID-19 (21%), lack of confidence in senior management/leadership (21%), and lack of flexible work hours or location (21%). Somewhat surprisingly, “not receiving promotions or raises I deserved” landed in number seven on the list at 19%.

Meanwhile, research conducted by Bank of America showed 61% of surveyed Latino small business owners said they cut their own pay during COVID to avoid having layoffs. A majority of Latino owners say they plan to make changes that are favorable to employees, such as allowing more flexible schedule or establishing additional monetary incentives.

For the U.S. Latino community, 57% of workers want more in-person time with their team post-pandemic, and 63% of business leaders are more likely to be planning to redesign office space for hybrid work.

Working remotely has benefits for both employees and employers.

According to research reported by career planning firm Zippia, working remotely has not only grown dramatically since COVID, but will continue to grow even after COVID. As of 2021, 26.7% of U.S. employees worked remotely, with that number expected to grow to 36.2 million by 2025. In addition, 16% of U.S. companies are now fully remote. In general, women seem to prefer remote work more than men, with 68% agreeing they’d prefer remote work post-pandemic, as opposed to 57% of men.

It appears working remotely has significant benefits for both employees and employers. 40% of workers believe they are more productive while working at home as opposed to the office. On the whole, remote workers are less stressed (57%), have improved morale (54%), take fewer sick days (50%), and most importantly, report having a better work-life balance (75%). Given those findings, it is no surprise that 68% of Americans would prefer to be fully remote.

Zippia also found that 75% of remote workers believe their work-life balance has improved, while 62% of workers feel remote work positively affects their work engagement.

From the employer perspective, remote workers are 13% more productive when working remotely, and overall worker productivity in the U.S. has increased by 5% since the start of the pandemic. Many companies have found they can often save money with remote employees. Between reduced commute times, fewer absences/sick leave, reduced turnover, and increased productivity, it is estimated that employers stand to save roughly $11,000 annually per employee.

It stands to reason that IT is the leading industry in terms of adopting remote work because IT jobs lend themselves to being able to be completed in a remote work environment. Other top industries for remote workers include Accounting & Finance, Customer Service, Healthcare, Marketing, Education, and Sales.

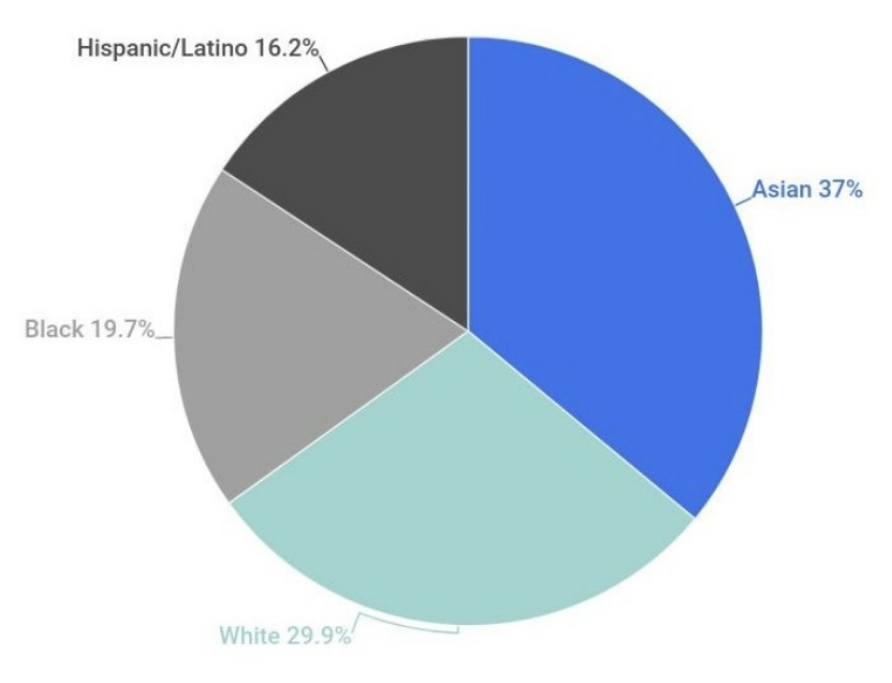

While U.S. Latinos have the highest employment rate of any population cohort, they make up the smallest percentage of U.S. remote workers. This is not surprising given that nearly one-third of the construction industry jobs, for example, depend on U.S. Latinos, and that supply chain companies are a growing portion of U.S. Latino-owned new businesses. The chart below shows the make-up of our current U.S. remote worker workforce.

U.S. Remote Workforce

Five types of workers identified in new research by Morning Consult

In a report from Morning Consult titled New Workers, New Normal, Morning Consult data scientists provide new insight into the post-COVID workforce garnered from survey research the firm conducted in January of this year among over 3,500 employed adults.

Based on that data, they were able to cluster responses into 5 types of workers in the “new normal” workforce in our country. We are offering here highlights from that report that may help you as an employer better understand how to recruit and retain your employees, and help you as an employee better define your own motivations.

The five types of workers include:

Minimalists who don’t expect much from their work other than a salary. They are more likely to be salaried, male, and more likely to work remotely or in a hybrid situation.

Transactionalists tend to view their work as something they do for the business and in return they get paid for doing it. They tend to be younger and part-time and don’t prioritize career growth. This group skews hourly, tends not to have dependents, and has the highest share of Gen Z adults.

Aspirationalists see their careers as a way to make a real impact in the world. They are drawn to employers with strong cultures and lucrative career paths. This group skews salaried, tends to work in person, and is most likely to be Millennials with dependents.

Traditionalists are those whose jobs provide a means of living and some sense of job satisfaction. They are most likely to work hourly and in person, and tend not to have dependents. Higher job satisfaction is their biggest differentiator from Transactionalists.

Lifestylists work to support their personal priorities and hobbies. They care about work as both a means of providing and as a source of benefits. They tend to skew female, a more likely to be hourly, and tend not to have dependents.

Of all these groups, Aspirationalists and Minimalists are the most likely to consider relocating for work. As Morning Consult points out, this is notable because these two groups are more likely to be salaried and in positions more likely to be asked to move for work.

The survey also found that 24% of employed adults in the U.S. plan to leave their current job to find a new job within the next year.

What one survey reports about

U.S. Latinos and Credit Cards

A recently released survey by debt.com en Espanol showed that U.S. Latinos reduced their credit card use and saved more during the height of the pandemic. It should be noted that the survey results were based on only 200 Latino responses.

Sixty-nine percent of respondents said they learned how much credit cards really cost by looking at interest rates and fees. The respondents added that they now not only look for low interest rate cards, but said they also cut back on their use and pay more than the minimum payment each month.

The top five common uses of credit cards among those surveyed are: monthly household purchases (55%), gasoline (51%), emergencies (43%). This is followed by spending for restaurant bills, airfare, hotels, and travel costs.

And while the vast majority (72%) have never used a credit card to transfer balances or consolidate debt, more than 55% of respondents have hit their credit card limit over the past year.

Meanwhile, Federal Reserve data, as reported in AXIOS, showed that Americans racked up the most monthly consumer debt in over a decade in February, amid a surge of credit card swiping.

The Federal Reserve’s monthly consumer credit report for February showed levels of consumer debt — not including mortgage debt — jumped by 11.3%. Revolving credit (typically credit cards) rose by 4% over January. Non-revolving credit, which includes auto and student loans, was up 8.4%.

Some experts think that climbing inflation and falling savings rates are forcing more people to use credit cards. It remains to be seen if that is now true for U.S. Latinos as well, contrary to the findings of the earlier debt.com survey.

National Recording Registry

Recognizes Latino Artists

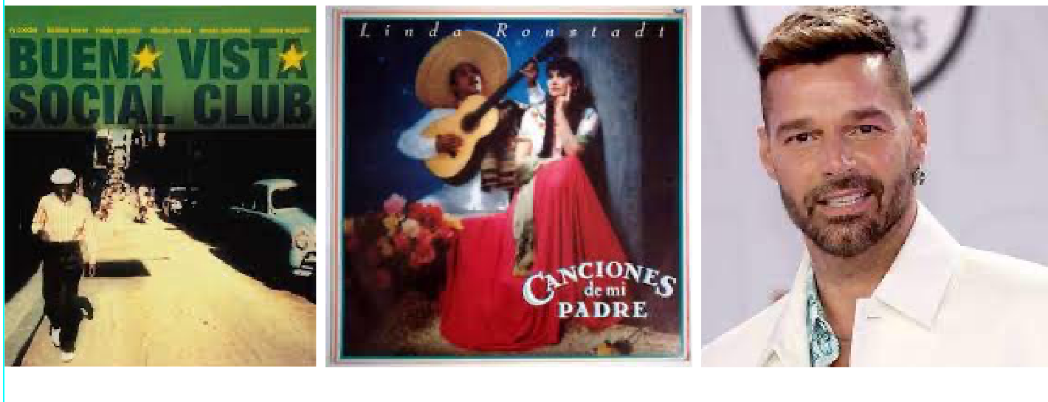

The National Recording Registry is a list of sound recordings that are considered significant to the culture and history of the United States. They are permanently preserved in the Library of Congress in Washington, D.C. Only twenty-five recordings are selected each year, and this year three Latino artists have been honored with their induction.

Latino musicians have been a major influence on the success of the music industry, have sold millions of records, redefined pop culture, and have been a major influence on upcoming artists. Those efforts have been recognized in 2022 by the Library of Congress with the announcement of three records by Latin artists earning recognition.

Placed in the Registry are Livin’ La Vida Loca by Ricky Martin, the Spanish-language album Canciones de Mi Padre by Linda Ronstadt, and the debut album of the Buena Vista Social Club.

Current Library of Congress Librarian, Carla Hayden, recently told NBC News, “These Latino artists are audio treasures worthy of preservation for all time based on their cultural, historical or aesthetic importance in the nation’s recorded sound heritage.”

These musicians are still considered icons in the music industry today. Their music has been a staple in the industry for decades and this is a major step forward for them to be honored and bring representation to Latin music lovers everywhere.