OCTOBER, 2021

U.S. Latino GDP now equal to France

as 7th largest economy in the world.

The Latino Donor Collaborative 2021 U.S. Latino GDP Report shows that the U.S. Latino GDP has grown to $2.7 trillion, which makes this the 7th largest economy in the world if it were an independent country. U.S. Latino GDP has now surpassed the GDPs of Mexico, Canada, Brazil, and Italy, and is now tied with France as the 7th largest GDP in the world.

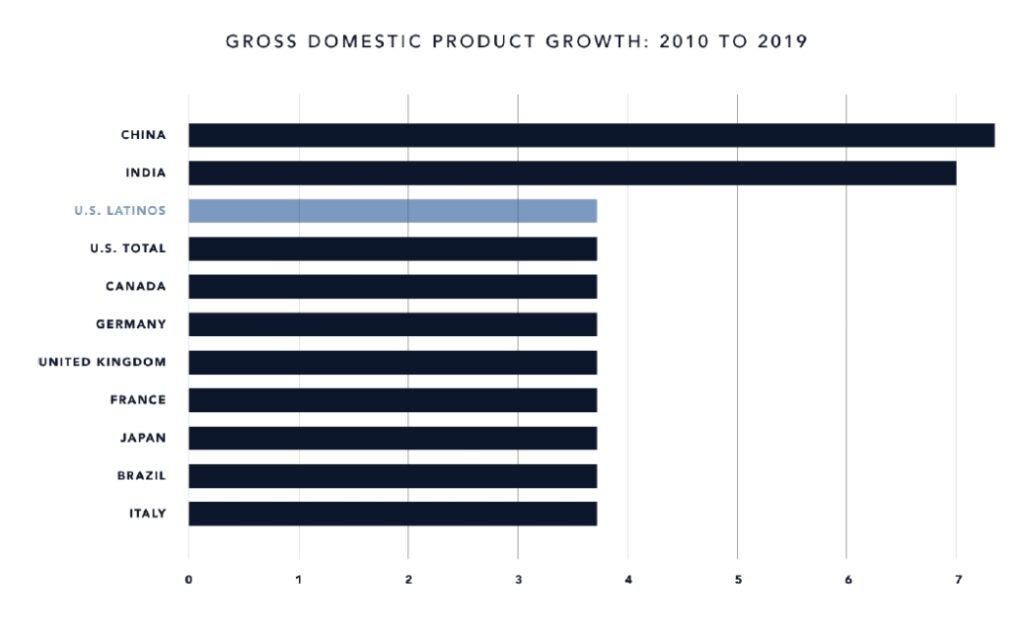

Not only is its size remarkable, so is its growth rate. Since the beginning of the study in 2012 U.S. Latino GDP has grown from $1.7 trillion to $2.7 trillion, making it one of the three fastest growing large economies in the world. In the past two years, U.S. Latino GDP growth has been double the growth of the U.S. economy as a whole.

It is important to note that this cohort makes up just under 20% of our population, yet it is generating 30% of the growth in our overall GDP over the past two years. That share of growth from U.S. Latinos is simply massive, and given all the growth factors associated with this cohort, that growth will only get bigger.

Given that 60% to 70% of our GDP is attributed to consumption, it should not be surprising to find that consumption by the U.S. Latino cohort has grown 123% faster than that of the rest of the economy. Consumption growth is made possible by income growth, which in turn flows from rapid gains in educational attainment and strong labor force participation, as demonstrated by the number of people with a bachelor’s degree or higher growing 2.8 times faster for Latinos than Non-Latinos from 2010 to 2019, and a U.S. Latino workforce participation rate that is nearly six percentage points higher than non-Latinos.

The scope of growth, breadth of growth, and rate of growth combined make this cohort not only an engine of our country’s economic growth, but also position it as a broad foundation for supporting the entire U.S. economy.

This new report, unveiled at L’ATTITUDE 2021, is receiving broad media attention and has major implications for marketers who want to grow, as this is the fastest growing large cohort in our country, making appealing to U.S. Latinos an imperative for any growth-oriented brand.

U.S. economy is losing $1.4 trillion annually

because capital is not flowing to Latino-owned businesses

Latino-owned businesses are the fastest growing segment of the small business ecosystem in our country. They are also one of the most overlooked, highest-return opportunities for investors, and their success could help shape the US economy’s growth for decades to come.

A core construct of capitalism is that capital will flow to wherever the growth is. However, in spite of this inordinate growth that has been occurring for nearly two decades, capital has not been flowing to this cohort, as indicated in a report released by Bain & Company at L’ATTITUDE 2021.

The pension funds and the tax payments and other capital flowing in our system attributed to the U.S. Latino cohort are significant and growing. The majority of this capital, however, does not make its way back into this growth cohort of Latino-owned businesses, who dramatically and opportunistically could drive even more growth if they had access and connections to the capital they need to scale their businesses. As this study found, Latino-owned businesses made up less than 1% of the $487 billion invested across the top 500 largest VC and PE deals in 2020.

This log-jam of getting capital to where a major source of economic growth is has remained consistent over the past two or three decades. Capital has continued to flow to the same cadre of companies and funds who deploy it in much the same places as they have in the past. This phenomenon helps explain why we have moved into such a unique concentration of wealth in our country … concentration of wealth in companies and in individuals.

In the latest OECD rankings, the U.S. has fallen ever further in the bottom third among all countries in the world … significantly worse than Russia and Romania. The lack of capital flowing to Latino-owned businesses limits their ability to scale and grow to their full potential, and unlike business debt which consumes cashflow, equity investment is “cost-free” in the early stages of a business.

The impact of the log-jam is not only limiting the ability of Latino-owned businesses themselves to grow, but is also limiting our entire country’s economic growth. For example, if Latino-owned businesses were to achieve a similar distribution of capital as non-Latino-owned businesses, our economy would experience an additional $1.4T. By 2030 that will be an incremental $3.3T. as pointed out in the Bain report.

Thanks to this new Bain report, the data is now available that shows Latino-owned businesses offer attractive investment opportunities for institutional investors of all types, including CDFIs, private equity firms, venture capital funds, and angel investors.

As was made clear in discussions at L’ATTITUDE, now what our country needs is action. It is imperative that we begin creating processes, fund structures, and tax incentives that will enable the flow of capital to one of the most significant growth opportunities of the 21st century, which is the U.S. Latino cohort.

U.S. Latinos are the most under-represented cohort

on Boards of Directors across the economy

The Latino Corporate Directors Association introduced its 2021 Latino Board Monitor report at L’ATTITUDE 2021. What may have been most startling in this report is that, as the second largest population cohort in our country, U.S. Latinos and Latinas are so dramatically under-represented on Fortune 500 Boards of Directors. In fact, they hold the smallest number of board seats of any cohort, with Latinas even more dramatically under-represented with the smallest number of board seats compared to any gender, racial, or ethnic group.

The LCDA report points out that representation on Fortune 500 Boards does not reflect our population, and is certainly not consistent with the fact this is our largest growth segment, and with GDP output that is growing at twice the rate of the U.S. economy as a whole. As noted in the report:

- Anglo-Americans represent 60% of the population, and 82.5% of board seats.

- Latino-Americans are 18.7% of the population, but only 4.1% of board seats.

- Black-Americans are just 13.4% of the population, yet 8.7% of board seats.

- Asian-Americans are 5.9% of the population, and 4.6% of board seats.

While the US Latino population grew by 3% in the last decade, Fortune 500 Latino representation increased by a shockingly low 1%.

LCDA’s research indicates 53 of Fortune 100 companies benefit from the US Latino perspective on their Boards. Still, however, 47 of the Fortune 100 have no Latino representation and now risk missing out on the booming Latino market share, growing 70% faster than the US general population.

This report also provides a listing of the companies with and without Latino board representation, and an analysis of the business ramifications for those who are continuing to operate outside the New Mainstream Economy.

Sol Trujillo, co-founder of L’ATTITUDE said, “Now that we all know the data, the question is, what are the market-based commitments that CEOs and Boards will now begin making, rather than giving speeches, and demonstrate actions that take advantage of having Latinos and Latinas on their boards so their companies stop leaving money on the table?”

America’s perceptions of U.S. Latinos

are changing

In an original research project conducted in 2012 by Hill & Knowlton for the Latino Donor Collaborative, it was found that about two-thirds of Americans held negative sentiment toward Latinos as being “takers” – taking away jobs, and taking away resources from social services and healthcare.

The 2021 report from the LDC, Perceptions of U.S. Latinos in America, based on current research by BSP Research, showed a much-improved fundament shift in perceptions away from being “takers” to being viewed as “contributors” – filling jobs, starting businesses, and adding to our economy. That positive perception is now held by 80% of the population.

While the American public’s perceptions have improved in many areas, the report makes clear there still remain areas of misperceptions that must be addressed. Two of those include a limited understanding of the manor contributions U.S. Latinos are making to our country’s workforce and economy.

Based on the progress made since 2012, this latest report provides hope that facts and data, partnered with continuous sharing, conversation, and education in broad based platforms such as L’ATTITUDE, reinforced by responsible media and forums, and acted upon by businesses that value the contributions and importance of U.S. Latinos in our New Mainstream Economy, will drive our country forward into the remainder of the 21st Century.

Growth in household wealth is narrowing

the non-Hispanic White & Latino wealth gap

While progress is being made in increasing Latino wealth in our country, the State of Hispanic Wealth Report from the National Association of Hispanic Real Estate Professionals, reveals some of the barriers to wealth creation across the cohort. The report, presented at L’ATTITUDE 2021, notes that Latinos are 1.7 times more likely to be an entrepreneur than any other racial or ethnic group, and that self-employed Latinos have a net worth five times that of Latinos overall. Unfortunately, at the same time Latino business owners face a wealth creation ceiling by not being able to scale their businesses at the same rate as Anglo-owned business due to lack of access to capital.

In fact, Latino business owners are 60% less likely to be approved for a business loan than their non-Latino counterparts, requiring them to use personal funds, thus reducing their ability to build wealth.

The good news for U.S. Latinos is that this cohort is nearing 50% home ownership, which is also good news for our country. The growth of this cohort, and their growing ability to buy homes, has resulted in 52% of new homeowners being U.S. Latino, which supports the entire home and construction ecosystem. U.S. Latinos are driving demand for real estate in our economy.

Home ownership is a strong wealth-building tool, demonstrated by the fact that homeowners have 28 times the wealth of renters. Home ownership also serves as a valuable tool for generational wealth, as children of homeowners are 7 to 8 times more likely to become homeowners themselves than children of renters. With one million U.S. Latinos turning 18 each year for the next three decades, the growth in home ownership among U.S. Latinos bodes well for America’s future.

A major challenge for this cohort pointed out in the report is the low participation rate in retirement accounts, with only 1 in 4 participating. The impact on personal wealth is dramatic, as U.S. Latinos who own a retirement account have nearly 10 times the wealth of those who don’t.

The more we understand the strengths and weaknesses of this cohort economically, the more actions we can take as a country to expand the ability of U.S. Latinos to create wealth will benefit every American’s future.

New Mainstream Latinos

are influencing a tech-empowered future

U.S. Latinos are driving digital consumption in our country. 98% of all Latinos own a Smartphone. 78% of all U.S. Latino households subscribe to a streaming service. In fact, U.S. Latinos are known as Super Streamers. They are dominating the use of APPS, with heavy usage in all categories including news, gaming, shopping, video streaming, dating, education, and messaging.

U.S. Latinos use more high tech devices including TV, Digital Streaming Devices, and Tablets. During Covid, they have been 57% more likely to use social media as a primary source of information about the coronavirus.

The “Latinos in Technology Report” presented at L’ATTITUDE by the Hispanic IT Executive Council, points out that while U.S. Latinos represent 28% of the population of the Silicon Valley, and 39% of all K-12 students, they represent only 3% of the high tech workforce. A key take-away from this report, therefore, is that our country needs more Latino interest in becoming Makers, not just Users. That is important to making certain games and apps, for example, are designed with a Latino context and without any non-Latino bias

Given the youthfulness of the U.S. Latino cohort, representing nearly 1 in 3 of the Alpha generation for example, together with this cohort over-indexing all others in most technology usage categories, the workforce in the technology sector will become increasingly dependent on U.S. Latinos. Attracting students to technology careers is important to both the economy and the culture of our country.

The more we understand the strengths and weaknesses of this cohort economically, the more actions we can take as a country to expand the ability of U.S. Latinos to create wealth will benefit every American’s future.

The media and entertainment sector is

missing its largest source of revenue growth

Latinos are the largest minority in America, the biggest driver of demographic and economic growth, and the youngest demographic group. Yet, they are vastly underrepresented in mainstream media content, as described by the Latino Donor Collaborative in its LDC 2021 Media Report presented by L’ATTITUDE 2021.

U.S. Latinos are the only major cohort that under-index in media representation. Accounting for nearly 20% of the total population, the U.S. Latino population is larger than the Black-America and Asian-American populations combined. Yet, they are only 5.5% of all screens representation, yielding a -71% representation ratio.

That means that a person is more than twice as likely to be an identical twin, than for a show to have a U.S. Latino lead actor.

Why does that matter? The Latino audience presents a lucrative business opportunity across the media landscape because of its size, its youth, growth rate, and economic power. The money being left on the table by the lack of Latino presence in media is a significant competitive opportunity, as demonstrated by the fact that nearly 3 of 4 U.S. Latinos are positively influenced to watch programming, subscribe to content, and purchase tickets for content that has U.S. Latino leads, casts, and producers.

U.S. Latinos already purchase nearly 27% of movie tickets. The report demonstrates the tremendous upside for the entertainment industry if it features U.S. Latinos in lead roles of mainstream content, and includes U.S. Latinos behind the camera as well. As the largest growth cohort in the country, growing to one-hundred million over the next three decades, U.S. media can no longer afford to ignore these drivers of our New Mainstream Economy.

$17.7 million invested in sixteen

Latino-owned businesses at L’ATTITUDE Match-Up

L’ATTITUDE Match-up is a national competition that matches US Latina/o entrepreneurs with institutional investors, awarding sizable investments, valuable connections, and specialized training and support for early-stage US Latino-led and owned businesses with large and high-growth opportunities.

In 2019, L’ATTITUDE co-founders, Sol Trujillo and Gary Acosta, along with Kennie Blanco, launched L’ATTITUDE Ventures to directly address a troubling economic cost to our country, which is the underfunding of U.S. Latino entrepreneurs. At this year’s L’ATTITUDE 2021 event, this venture fund provided $17.7 million in funding to 16 companies..

Through a highly competitive evaluation and selection process, 23 entrepreneurs were invited to showcase their companies before large institutional investors, individual investors, and a diverse audience of business owners and industry leaders.

From those presentations, four companies with the strongest business case, market and industry dynamics, and founding teams competed in a main stage final pitch for the title of “Latino Entrepreneur of the Year,” with equity investments awarded to each of them ranging from $500,000 to $1.5 million by L’ATTTUDE Ventures and guest judges

Over 100 Latino-owned companies applied for the competition, from which 23 were invited to the L’ATTITUDE showcase opportunity. Of those companies, 12 had Latina founders. During Match-up, sixteen of the 23 companies received funding from $100,000 to $5 million.

The four finalists included:

- Olivia Ramos, CEO and Founder of Deepblocks, an intelligent analytics platform revolutionizing the real estate development market

- Cayetana Polanco, co-founder of Keyo, a palm-vein biometric vertically integrated technology platform

- Eric Aguilar, CEO of Omnitron, advanced semiconductor materials developer for the autonomous vehicle industry

- Adriana Vazquez, CEO and co-founder of Lilu, tech-enabled and smart garments to empower new moms

- Maria Palacio, CEO & co-founder of Progeny Coffee, an end-to-end coffee distribution company that “adopts a farm” to uplift coffee farmers and bring premium products directly to the home.

The judges selected Eric Aguilar as Entrepreneur of the Year saying they believed his company has the largest growth potential.